when will capital gains tax increase in 2021

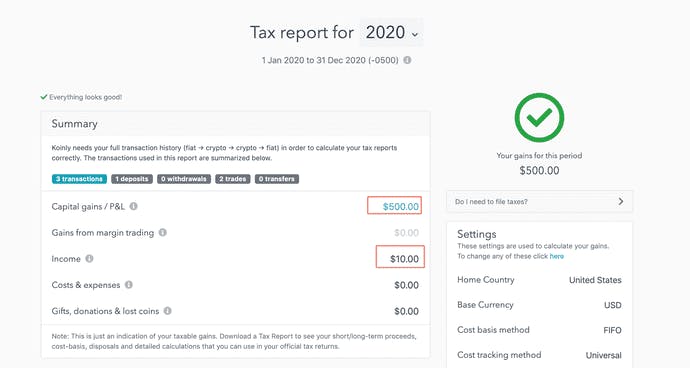

Last year I made about 200k from crypto and realized most of those gains in 2021. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021.

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

. Individual Income Taxes Capital Gains Tax Rate Update for 2021 June 7 2021 The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more than 1 million. In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy. The top rate for capital gains tax may increase from 29 to 49 percent state and federal rates combined.

PoolGetty Images Capital gains tax is. Go deeper 1 min. Inside the numbers.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Assets held for a year or less are considered short-term capital gains while assets held for longer than a. When an investor sells a stock for more than the purchase price the investor experiences a capital gain it is simpler to call it a profit but lets stick to some technical terms for a minute.

The increase in Capital Gains Tax receipts is being driven by a. Biden reportedly is considering a proposal of a 396 top rate on long-term capital gains up from the current 20 rate. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

The 238 rate may go to 434 an 82 increase. The long-term capital gains tax rate is typically 0 15 or 20 depending on your tax bracket. Add state taxes and you may be well over 50.

Added to an existing 38 surtax on net investment income and the total tax bite would be 288. Rising from 98bn in 201920 to 149bn in 202122 the huge increase comes after changes to the tax and rising house prices. There is currently a bill that if passed would increase the capital gains tax in Hawaii to 11.

Its time to increase taxes on capital gains Posted on January 7 2021 by Michael Smart Michael Smart To address wealth inequality and to improve functioning of our tax system tax rates on capital gains income should be increased. Those with less income dont pay any taxes. The effective date for this increase would be September 13 2021.

The current tax preference for capital gains costs upwards of 15 billion annually. Im a college student 22 years old. The rate could be as high as 396 matching the top ordinary income tax rate before the Tax Cuts and Jobs Act TCJA.

The rates do not stop there. I dont know what to do since I have no other income and a minimum wage job isnt going to cover anywhere close to the tax liability. Apr 23 2021 305 AM Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said.

Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021. 13 2021 the date. Long-term capital gains are.

If you have a long-term capital gain meaning you held the asset for more than a year youll owe either 0 percent 15 percent or 20 percent in the 2021 or. The bottom 99 on. But because the higher tax rate as proposed would only.

For example if you bought Amazon at 2000 back in July of 2019 and sold it for 3500 at the end of November of 2021 the capital gain would be 1500. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. I lost it all in 2022.

The proposal would increase the maximum stated capital gain rate from 20 to 25. After coming into office President Joe Biden proposed some new tax laws in 2021 which may be passed when current rules expire in 2022. The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019.

The new rate would apply to stock and other asset sales that occur after Sept. How much these gains are taxed depends on how long the asset was held before selling. Another would raise the capital gains tax rate to 396 for taxpayers earning 1 million or more.

I filed for a tax extension in April and only paid 10k worth. Additionally a section 1250 gain the portion of a. Still another would make the change.

When the NIIT is added in this rate jumps to 434. As proposed the rate hike is already in effect for sales after April 28 2021. He also is expected to maintain an ACA-related investment tax bringing the total federal rate to as high as 434 as first reported by Bloomberg and confirmed by Axios.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

What You Need To Know About Capital Gains Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Can Capital Gains Push Me Into A Higher Tax Bracket

Capital Gains Tax What It Is How It Works Seeking Alpha

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Exemption From Capital Gains On Debt Funds Paisabazaar Com

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

What You Need To Know About Capital Gains Tax

How To Pay 0 Capital Gains Taxes With A Six Figure Income

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax What Is It When Do You Pay It

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)